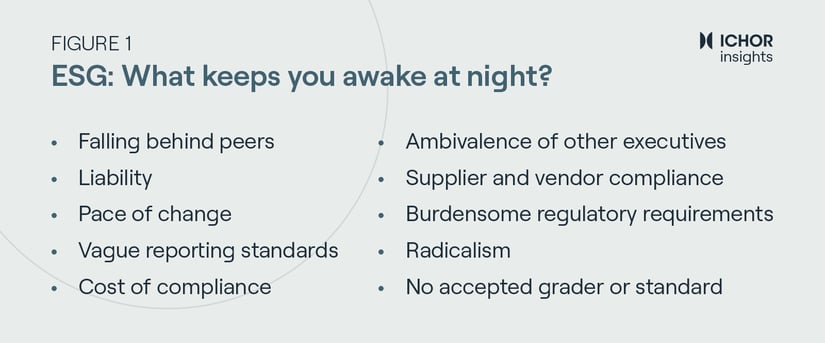

Environmental, Social, and Governance (ESG), specifically anticipated government regulation, was a prominent topic for in-house counsel at the 2022 Association of Corporate Counsel’s (ACC) annual conference this past Fall in Las Vegas. Throughout the conference, speakers emphasized the growing importance for all companies – big and small, public and private, and B2B and B2C – to understand their stakeholders’ demands as ESG reporting moves from voluntary to mandatory. Below, we outline preliminary strategies for addressing in-house counsels’ most prevalent concerns regarding ESG compliance and reporting (see Figure 1 for the full list), using both ACC panelist recommendations and Ichor’s expertise from consulting Fortune 1000 companies on these issues.

Radicalism From Both Sides

BlackRock, the world’s second-largest asset management firm with $7.96 trillion assets under management (AUM), has had to reconcile competing demands from consumers, shareholders, politicians, and legislators. Consumers and climate activists, in particular, have accused the company of not doing enough to combat climate change. Shareholders, such as activist hedge fund Bluebell Capital Partners, are currently pursuing an Engine No. 1-type strategy in asking CEO Larry Fink to step down for overly prioritizing ESG. From NYC Comptroller Brad Lander demanding the firm take stronger action toward net-zero emissions to several attorneys general from Republican states accusing BlackRock of prioritizing “activism” over fiduciary duty (with some states withdrawing their investments completely), politicians have run the gamut.

The ”anti-woke” backlash from the right has become louder over the past year. Activist investors on both sides saw the strength and potential of their voice when the hedge fund Engine No. 1, which held 0.02 percent of ExxonMobil’s shares, successfully won three board seats in May 2021 by teaming up with three of the gas company’s large investors. One year later, activist investors like Vivek Ramaswamy of Strive Asset Management and Bluebell Capital Partners made headlines for accusing companies of prioritizing “liberal politics” over maximizing profit. Republicans in Congress, who won the majority in the House last month and gained committee leadership, have been vocal about their commitment to hearings on “woke capitalism.” According to prominent speakers at ACC, the politicization of ESG has only just begun.

Despite the noise from the top, it remains clear that tangible and measurable ESG commitments remain a priority. A 2021 survey of more than 5,000 consumers in five countries found that ESG commitments are a major factor driving consumer purchases 1. In less than five years, ESG-related assets are projected to constitute 21.5 percent of total global AUM 2. As Scott Nader of Saudi Aramco, an ACC panelist, proclaimed, “every risk has an opportunity associated with it.”

New Regulations but Vague Reporting Standards

ESG regulations are moving from voluntary to mandatory, a theme that recurred throughout the conference, with European regulators leading the way 3. The SEC-proposed disclosure requirements, despite some pushback, are broadly in line with current UK and EU regulations against which multi-national corporations may already be required to report. Organizations like the Global Reporting Initiative, Greenhouse Gas Protocol, and Sustainability Accounting Standards Board publish reporting standards, but the need to align these standards will increase as new regulations are put in place. Without clear alignment, corporations are forced to interpret the regulations themselves, opening them up to risk.

The SEC-proposed rules include the disclosure of climate-related risks, governance and processes, GHG emissions, line-item impacts of climate events, and transition activities. The largest change is the inclusion of climate financial statement metrics, including policy decisions, which disclose a company’s ESG risks and data to shareholders. While private companies may not be directly impacted by these regulations, those that are part of regulated supply chains or considering IPOs will need to pay close attention to the changes. Additionally, consumers driving demand for greater ESG oversight will expect transparency and responsible business practices from private, particularly large and B2C, companies regardless of ownership.

Falling Behind and the Pace of Change

The largest benefits of a rapidly changing landscape are the opportunities to establish a position of leadership, pioneer a proactive narrative, and shape how companies are thinking about ESG reporting requirements. While there is no foolproof way to avoid criticism or litigation, there are steps that companies can take to mitigate the risks (see Figure 2 for a full checklist to get started):

- Corporations that have seen success have built ESG into their governance and core business strategies. They’ve ensured alignment through sustained commitment from leadership throughout all levels of their organization. For example, Chobani, the United States’ number one yogurt brand, has a mission to “make high-quality and nutritious food accessible to more people, while elevating communities and making the world a healthier place.” This mission was built into Chobani’s business strategy when it was founded and is reflected throughout its supply chains, manufacturing practices, hiring stages, and incubator program for small food startups. Other companies in the Fortune 100 tie ESG progress directly to leadership compensation.

- From qualitative insights to quantitative KPIs, companies have an opportunity to shape the narrative around the data that will be made public. By reviewing their internal data, deciding what to disclose up front, and having conversations with all their stakeholders, from board members to communities impacted by their decision-making, companies can begin to understand the breadth of their own accountability and impact. For example, Ichor worked with a Fortune 100 manufacturing company to understand how its workforce diversity strategy and EEO-1 data, especially in regard to recruitment and retention, would be perceived both internally and externally. The company proactively engaged employees and worked with Ichor to pressure-test the company’s annual diversity, equity, and inclusion report from an external perspective prior to publication.

- When establishing measures of success, corporations should, of course, push the fold but avoid making overly aspirational goals. Unmet goals can not only invite the possibility of external audits but also damage the trust between the corporation and its stakeholders. Since 2018, when Tyson Foods announced a goal to reduce greenhouse gas emissions 30 percent by 2030, the protein producer has instead increased its emissions by three percent annually, on average. This increase will make it difficult, if not impossible, for Tyson to meet its 2030 goal and could decrease the company’s credibility with consumers. Companies that build deep, long-lasting relationships and partnerships with their communities through open dialogue will be able to develop mutually beneficial goals and identify reputational risks before they spread. One way to stay on track and identify emerging gaps between strategy and impact is to have an internal audit proactively conducted using an independent third party.

If you want more actionable ways you can prepare for the future of reporting, get in touch with our team here.

1 “Beyond compliance: Consumers and employees want business to do more on ESG,” PwC, accessed 12/8/2022.

2 “ESG-focused institutional investment seen soaring 84% to US$33.9 trillion in 2026, making up 21.5% of assets under management: PwC report,” PwC, 10/10/2022.

3 “ESG Trends – What the boards of all companies should know about ESG regulatory trends in Europe,” Harvard Law School Forum on Corporate Governance, 11/1/2022.